Yesterday, I attended the Baltimore County Council Budget Legislative Session. The Council convened to vote on County Executive Johnny Olszewski’s budget and all related bills. The good news is that the package passed largely intact. There were some changes, which I’ll explain below, but I’m excited to say that Baltimore County will be moving forward with some significant progress.

First, a bit of background: the County Executive inherited an $81 million dollar deficit that had to be addressed before he could even move forward with his priorities. This in a county where for decades county executives have bragged about not raising taxes. County Executive Olszewski had no choice but to raise taxes, a decision that required considerable political courage. Along with that, he found $20 million in savings he could cut from the budget. All of that enabled him to close the deficit and move forward with some exciting initiatives. See my Baltimore Sun op-ed for more details.

The most controversial part of the package turned out to be the cell phone tax. The county has long had a tax on landlines, but as more people are getting rid of their landlines in favor of cell phones, the county revenue has been declining. So a tax on cell phones seemed a good solution. However, while $3.50 per line per month doesn’t seem like a lot, the problem is that many families have multiple cell phones, and it really starts to add up, a problem that I admit I didn’t see when I wrote my op-ed. So the county council amended the bill to change it from a flat $3.50 per phone to 8% of the voice line portion of the cell phone bill only. The 8% does not apply to your data fee or any other charges on your bill, and in most cases will be significantly lower than the $3.50 flat fee. This will reduce the revenue to the county from this tax, but still provide some additional revenue while giving much needed relief to Baltimore County families.

Another controversial part of the package was the implementation of development impact fees. These fees are imposed on new development as a way to help mitigate the impact of development on infrastructure. Almost everyone (except many developers) agreed that impact fees are needed, but there was disagreement on how to implement them. The County Executive’s bill would impose a development impact surcharge, essentially an excise tax, that could be used for capital projects anywhere in the county. Councilman David Marks also introduced a development impact fees bill, but his would have been true impact fees, requiring that the fees collected from developments be spent for capital projects only in the area of the county where the development occurred.

In the end, the two bills were combined in a grand compromise. There were many changes, but essentially the compromise bill enables fees collected on commercial development to be used anywhere in the county, while fees collected on residential development can only be used in the region where the development occurred. The compromise bill also changes the fee structure to charge a percentage of sale price for residential development, rather than the flat fee in the county executive’s bill, a change which I think makes the bill more fair to purchasers of varying incomes.

Of the two original bills, I preferred the county executive’s version. In my opinion, restricting the fees to the area of the county where development occurs would unnecessarily tie the county executive’s hands and prevent him from using the fees to address the most critical county needs. It also would mean that areas of the county that are already mostly developed — like southwest Baltimore County — have less space for new development and thus would receive less from impact fees, yet we already have infrastructure strained from previous development.

However, compromise is how government is supposed to work, so I’m glad that the county found a way to move forward in a bi-partisan way on this important initiative.

The rest of the bills passed with little fuss. The income tax passed along party lines with no debate. The hotel tax increase passed, although the council amended it to raise the tax to 9.5% instead of the county executive’s proposed 10%.

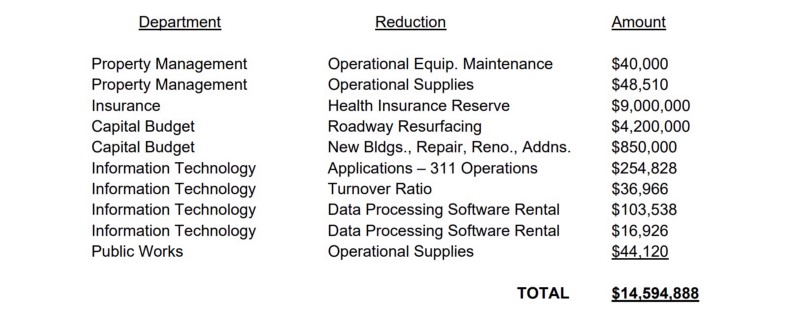

The county council made about $14 million in cuts to the budget in order to compensate to the cuts in revenue from the changes outlined above. The biggest cuts were $9 million from the health insurance reserve and $4.2 million from roadway resurfacing. The full list of cuts is below.

The amended budget passed 6–1, with Councilman Crandall voting no.

In the end, Baltimore County will still be able to move forward with the county executive’s important initiatives, including an opioid strategy coordinator, a diversity officer and a sustainability officer, a 2% COLA for teachers, $1 million for bike lanes and pedestrian improvements, and much more, and we are moving towards better fiscal sustainability.